In June 2022, North Highland connected with over 560 leaders across key industries—including financial services, healthcare, health and human services, life sciences, and transportation—to better understand the trends and challenges confronting today’s businesses as they navigate the end-to-end transformation journey. What we discovered is a desire to build more adaptive operations to power continuous transformation; a need for greater alignment across employees and leadership teams around transformation strategy; and opportunities to integrate data and analytics into every step for greater success. Amidst the transformation that is reshaping our economies and societies, every business has a clear path to a better vantage point. In this blog series, we'll uncover what it takes for each industry to maximize its transformation potential.

The financial services industry is at a crossroads. The market is changing so quickly that incumbents must rethink their businesses and how they operate them. From an onslaught of new competitors to changing customer needs and preferences to new technology and data sources; the very nature of financial services is being redefined.

In response, industry leaders are striving to build flexible transformation strategies—ones that allow them to adapt quickly to current and future change and remain competitive.

In a June 2022 survey of 86 financial services leaders, North Highland uncovered trends and challenges confronting the industry’s leaders as they navigate the end-to-end business transformation journey.

Our research highlighted three avenues for greater transformation success in financial services this year and beyond. To build transformation strategies that deliver competitive differentiation, leaders must:

- Integrate real-time insights;

- Cultivate a change-ready operating model; and

- Secure strategic alignment among leadership teams and employees.

In this blog, we’ll explore these opportunities and share key trends that are top of mind for financial services leaders. We’ll then send you on your way with your first steps to gain a winning vantage point over your competition.

YOUR NEXT VANTAGE POINT: TAKING REAL-TIME ACTION WITH DATA

Our research revealed financial services leaders see the criticality of using data and analytics (D&A) in transformation and aspire to tie insights more strongly to strategic vision-setting. But, when it comes to delivering on transformation strategies, few have mastered the art of turning insights into action.

For financial services, D&A plays a prominent role in the early stages of a transformation journey: Defining the transformation strategy, setting priorities, and designing the strategy. Fifty-five percent of industry leaders use data to define their transformation strategy and 53 percent consider these capabilities when designing their transformation strategy. Further, enhancing analytics capabilities is one of the key factors leaders prioritize to gain a competitive advantage (according to 38 percent of leaders).

The use of data becomes a bigger challenge for financial services in the transformation delivery phase. Our research revealed a mere 17 percent of industry leaders say they use data and digital capabilities to deliver, manage, and measure transformation.

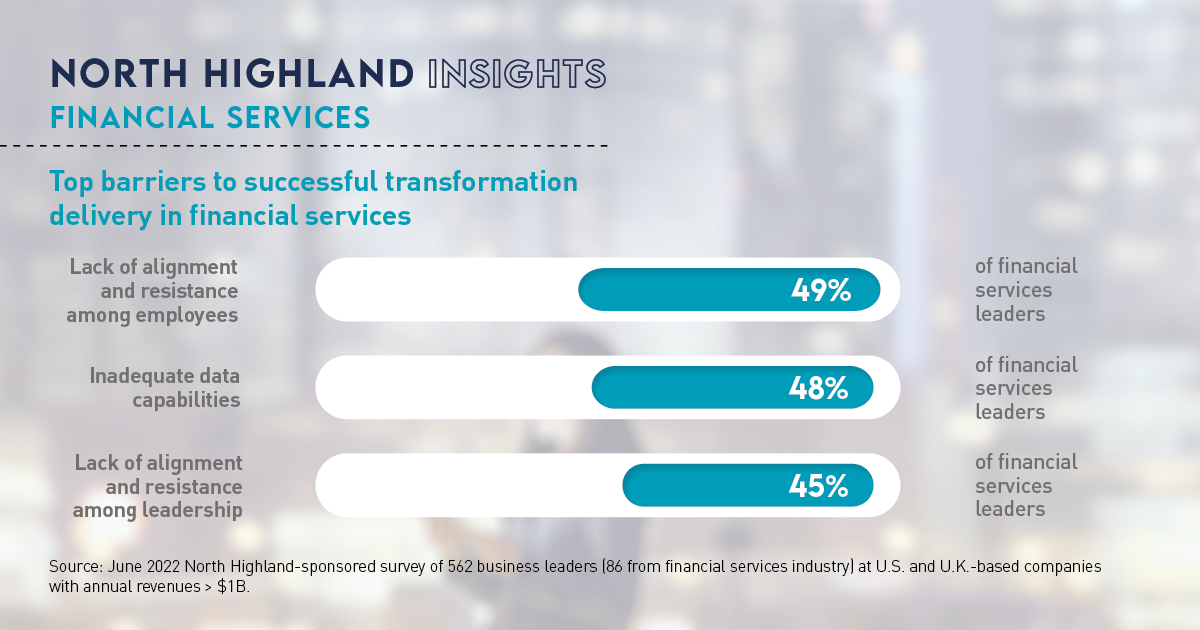

The industry’s underutilization of D&A in the transformation delivery phase may be a result of inadequate data capabilities and infrastructure: While 49 percent of financial services leaders say they are confident in their data and digital tools and capabilities, 48 percent of individuals also say that inadequate data capabilities pose a barrier to successful transformation delivery. Confidence likely lies largely in technology capabilities for the industry, given its focus on digital transformation in recent years. In fact, 59 percent of financial services leaders indicate technology is a top facilitator for delivering on a transformation strategy.

There is a clear opportunity for industry leaders to harness the power of data throughout the entire transformation journey to maximize value and results.

YOUR FIRST STEPS

Financial services leaders and teams can tap into alternative tools and approaches that combine the power of D&A with their already powerful technology stacks. These are your first steps:

- Boost data capabilities across your operating model. When considering how data can support an overall transformation strategy from start to finish, we often turn first to data blueprinting. Data blueprinting allows you to identify the data consumed or created at every customer or employee interaction and map out the best way to use the data to support operations, processes, technology capabilities, and more. With this roadmap, your business can more effectively apply insights to deliver on transformation strategies.

- Rely on data to overcome obstacles to data dexterity. Financial services leaders are collecting data and understand the value of doing so. Yet, there are roadblocks for many in taking any action against these insights.

To overcome this barrier, it’s critical to build a culture of data-driven decision-making (requiring enterprise data literacy), which will bring your workforce into alignment. We recommend an approach focused on workforce engagement and driven by Voice of Employee (VoE) insights—and onein which you apply learning in real-time via structured and unstructured data sources. AI-enabled analytics pinpoint factors that most greatly influence and motivate employees to adopt data in daily working practices.

To overcome this barrier, it’s critical to build a culture of data-driven decision-making (requiring enterprise data literacy), which will bring your workforce into alignment. We recommend an approach focused on workforce engagement and driven by Voice of Employee (VoE) insights—and onein which you apply learning in real-time via structured and unstructured data sources. AI-enabled analytics pinpoint factors that most greatly influence and motivate employees to adopt data in daily working practices.

YOUR NEXT VANTAGE POINT: CULTIVATING A CHANGE-READY OPERATING MODEL

Adaptability is top of mind for financial services leaders, and 66 percent of respondents to our survey state they are focused on establishing an operating model that enables frequent, incremental change (“little and often”) to achieve flexibility.

While leaders acknowledge the importance of building flexible operations—with 50 percent saying integrating flexibility and adaptability into ways of working and operating is critical for successful change—the operating model is not a priority throughout the entire transformation journey. Industry leaders are focused on operations as they define and design their transformation strategies, but the operating model begins to fade into the background when it comes time to actually deliver on that strategy, much like the tale with data.

When defining transformation strategies, modernizing operations and operational infrastructure is a top priority to gain a competitive advantage (according to 37 percent of leaders we surveyed). When designing transformation strategies, operational expertise is also a prime consideration for more than half (53 percent) of financial services leaders.

But when delivering on transformation strategies and measuring success, there are operational shortcomings: Only 29 percent of leaders believe the operating model allows their organization to deliver on transformation strategies. This may be because just 22 percent of industry operations leaders have a seat at the table when developing transformation strategies. Without early involvement and clarity around transformation strategy, it’s difficult for those tasked with operationalizing transformation to make an impact.

Additionally, while financial services leaders see integrating flexibility and adaptability into ways of working and operating as critical for successful change, only 31 percent of leaders feel confident they can easily measure these characteristics.

YOUR FIRST STEPS

Leaders in financial services have an opportunity to cultivate change-ready operating models and more effectively measure operational performance. These are your first steps:

- Invite operations to the table. As competitive and market forces change, the core elements of your operating model cannot be static. You need to build adaptive operations, so it’s critically important to bring the right mix of leadership to the table early in the transformation process to deliver a cross-functional perspective and sustain a systems mindset in end-to-end operating model planning. That means leaders overseeing operations must have a seat at the table from strategy setting all the way to measuring transformation success.

- Forge a flexible strategy and operating model with built-in adaptability. Use a combination of design, systems, and scenario thinking—a mindset we call DSS Thinking—to set a strategy and operational blueprint that can flex to accommodate a range of potential futures. Right now, these three techniques are low on the list of strategies used by industry leaders, but they are powerful tools for designing adaptive operations.

- Get creative with KPIs. In measuring the success of your transformation, look beyond conventional KPIs, such as revenue or cost. For instance, consider those that reflect the degree of flexibility and adaptability in your business operations (e.g., speed to market). Identify the sources of data you'll need to track your progress along the transformation journey.

YOUR NEXT VANTAGE POINT: ALIGNING LEADERS AND EMPLOYEES

An adaptive strategy, supported by a flexible operating model, requires strategic alignment across the enterprise, yet over half of financial services leaders struggle to align with their peers and employees.

Those we surveyed acknowledge the need for alignment among leaders in order to implement their transformation strategies: 60 percent said it’s important and 38 percent said it’s somewhat important. However, there are frequent challenges to achieving leadership alignment, according to 56 percent of those we asked.

Misalignment among financial services leadership is a result of a lack of clarity around transformation and disagreement on drivers of value. Additionally, based on our research, financial services leaders are not heavily focused on driving leadership alignment, despite recognizing its impact on transformation success. Improving leadership alignment falls to the bottom of the list of industry respondents' priorities when defining a transformation strategy to gain a competitive advantage. Further, leadership alignment is hardly considered (by only nine percent of respondents) when designing transformation strategies and when delivering on those strategies.

With that said, leadership alignment in financial services is not altogether forgotten. To define clear transformation strategies, leaders say they turn to leadership coaching and alignment as a critical technique.

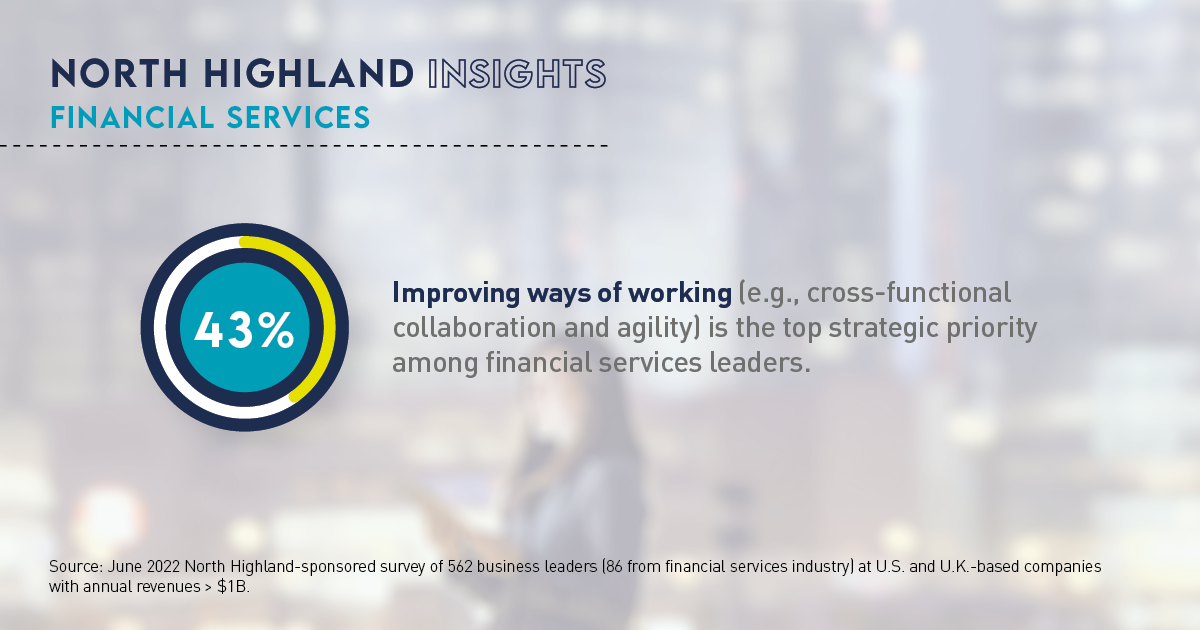

Lack of employee alignment presents an even larger obstacle for the industry: It’s ranked as the number one barrier to delivering on transformation strategies. Change saturation, the pace of change, and lack of clarity around future-state roles are to blame, according to our survey. Since it’s a significant challenge for the industry and the top barrier to transformation delivery, leaders in financial services are keen on aligning employees. Nearly half (43 percent) of leaders are striving to improve ways of working to achieve transformation strategy alignment this year and into 2023. They are also co-creating strategies with employees, more so than any other industry we surveyed. In fact, co-creation is cited as a top technique for tapping into the value of people, and 77 percent of financial services leaders agree employees bring value by providing feedback on the direction of the transformation.

While respondents say they frequently collect data from employee engagement surveys (47 percent), only 33 percent use D&A to actually support employee alignment (again, reinforcing the need for financial services leaders to take the next step with data and turn insights into actionable solutions).

YOUR FIRST STEPS

An adaptive strategy, supported by a flexible operating model, requires alignment across the enterprise. Financial services leaders can overcome alignment challenges by focusing on these first steps:

- Create a comprehensive case for change. When leadership teams struggle to unite around a transformation strategy, data can answer questions and provide insights without personal investment. Bring leadership stakeholders together to evaluate customer, workforce, and operational data and align on the value drivers that are most important in the context of your shared transformation vision and strategy. Data provides clarity around and alignment on priorities.

- Look beyond static surveys. With the right analytics tools, leaders can better understand the underlying “why” behind the VoE. Leverage AI-enabled analytics platforms to add thoughts, emotions, feelings, and cognitive states to key topics. This analysis allows you to pinpoint the most significant drivers of employee sentiment and behavior. With insight into the drivers that are most impactful, you can prioritize initiatives and interventions that promote alignment, encourage adaptive behaviors, and minimize change saturation.

- Keep a long-term view in your workforce planning. While we’ve learned that the future is never set in stone, maintaining a long-term view in workforce planning is a key trait of change-ready organizations. But only 17 percent of industry leaders say they engage in future-focused workforce planning to tap into the value of people in their transformations. Leaders can use data to identify pain points and capability gaps standing in the way of delivering on transformation strategy. With these insights, you can consider the expertise you’ll need to close those gaps and begin to define future-state roles. By creating clarity around future roles, you’ll break down a top barrier to employee alignment.